We recently upgraded to a new core banking system as part of our commitment to provide you with state-of-the-art tools and technology to transform your banking experience and help you reach your goals. Thank you for your patience during our core system upgrade. As of March 10 at 8 A.M. ET, all banking services and systems are available as usual.*

Below, please find information and steps to follow now that the conversion is complete.

If you have additional questions, please reach out to customer service at customerservice@cfg.bank, call 888-205-8388 or 410-823-0500, or visit one of our branches.

*Note: Zelle will be available on March 12. See details about Quickbooks, Quicken, and Mint potential interruptions, here.

Now that our conversion is complete, below please find a to-do list with actions to complete. Reminder, no changes were made to impact your account number(s), checks, direct deposits, or BillPay payees.

Confirm accuracy of information in Online Banking

- Check the accuracy of your personal information (address, phone, email, and e-statement enrollment) either through your Online Banking profile or by contacting Customer Service at customerservice@cfg.bank or 1-888-205-8388. Make updates in Online Banking or by contacting our team.

- Note: First time login instructions were sent via secure message in the old Online Banking system. For security purposes, you will need to update your password after logging in. If you need assistance, please contact Customer Service.

Redownload Mobile Banking app

- To access your account(s) via Mobile Banking, you will need to visit the App Store or Google Play to redownload our app. Use keywords “CFG Mobile Money” to easily find the app in the App Store or click here. Use keywords “CFG Banking” to easily find in Google Play or click here. Your login information will be the same as Online Banking.

Re-add payee information for external transfers

- You will need to re-enter all accounts that you send money to in the new system.

Activate and use new debit cards

- Activate your new debit card using the instructions provided with the card in the mail.

- If you use Apply Pay or Google Wallet, add your new debit card.

QuickBooks, Quicken & Mint users to execute remaining conversion instructions

- Review and execute the remaining steps of the conversion instructions.

Re-add Zelle payees

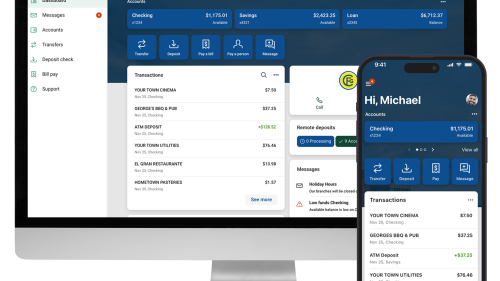

Online banking

Access your accounts and information in Online Banking using the link on our website. First time login instructions were sent via secure message in the old Online Banking system. Note: for security purposes, you will need to update your password after logging in. If you need assistance logging in please contact Customer Service.

With the system upgrade, Online Banking looks a bit different as we provide you with an enhanced experience.

Note: If you had Online Banking bookmarked in your search engine, you will need to replace with the new link.

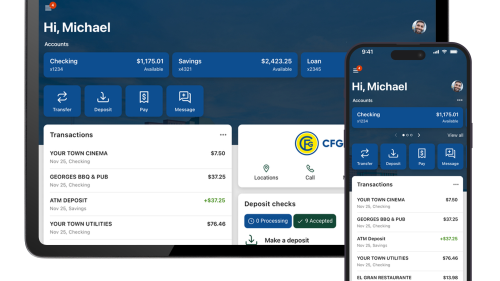

Mobile banking

To access your account(s) via Mobile Banking, you will need to visit the App Store or Google Play to redownload our app. Use keywords “CFG Mobile Money” to easily find the app in the App Store or click here. Use keywords “CFG Banking” to easily find in Google Play or click here. Your login information will be the same as Online Banking.

With the system upgrade, new features allow you to:

- Reset username and password

- Initiate first time external transfers

- Enroll in BillPay and create payees

- Send messages to CFG representatives

Mobile Banking looks a bit different as we provide you with an enhanced experience.

*The Mobile Banking App is only supported with the U.S. If you are not based in the U.S., please use on Online Banking.

Customers using Quickbooks, Quicken, and Mint, please review the below instructions to execute the remaining needs for your QuickBooks or Quicken software.

Be sure to complete the deactivation/reactivation of your online banking connection to ensure that you get your current Quicken or QuickBooks accounts set up with the new connection.

Please note:

Intuit aggregation services may be interrupted for up to 3-5 business days, following conversion completion on March 10. During this interruption Quicken Win/Mac Express Web Connect, QuickBooks Online Express Web Connect, and Mint may not be accessible. Users are encouraged to download a QBO file during this outage.

Please carefully review your downloaded transactions after completing the migration instructions to ensure no transactions were duplicated or missed on the register. If you have any questions, please contact us at (410) 823-0500.

Have a question?

What is a core processing system upgrade?

A core processing system upgrade means we improved the technology we use to service you when you visit a branch or use our online banking systems.

Why was the system upgrade necessary?

Conversions to new core systems are very common for financial institutions as they seek to offer a more robust client experience and support client financial needs well into the future. Several service enhancements are now available, including faster transaction times and an enhanced online banking experience.

How does the upgrade benefit me?

Your experience is improved. You have access to more services and are able to conduct banking faster, in addition to, improved online and mobile banking services as well as an overall improved service experience.

When did the upgrade take place?

The system upgrade began on Friday, March 7 at 8 A.M. ET and was complete on Monday, March 10 at 8 A.M. ET.

Were my funds and personal data safe during this upgrade?

Yes. Your funds and personal data were completely safe during the conversion.

Did my account number change?

No. Your account number did not change. Continue to use your current account number.

Did I lose my account history?

Starting in July, twelve months of historical statements will be available.

My ATM/Debit card was closed and I ordered a new card. When will I receive a new card to activate?

We sent cards to customers who ordered new cards between February 10 and March 6. If you have not received your card, please contact Customer Service at customerservice@cfg.bank, call 888-205-8388 or 410-823-0500, or visit one of our branches.

Why did I receive a statement showing account activity from March 1 through March 6?

At the end of the day on March 6, account information was transferred to the new system. We are required to provide you with a statement in the old system as of March 6. This statement included any interest earned for the period of March 1 through March 6.

When will I receive my statement from the new system?

The new system will provide statements at the end of the month. You will receive a statement dated March 7 through March 31, with interest accrued on those dates. Statements will be delivered on their regular schedule moving forward. Statements will look very similar but if you have any questions or concerns when you receive the new statement you can contact Customer Service.

Why were your systems offline on Friday, March 7?

Between March 7 and March 9, we transferred all our customer data to our new system.

How can I access my 2024 tax forms?

For your interest-bearing CFG Bank accounts, 1099-INT form(s) will be retroactively added and available at the end of June. You can request your 1099-INT form(s) and any other statements through Online Banking, by selecting “Messages” and sending a message to our team who can securely send the file(s) to you.